Table of Content

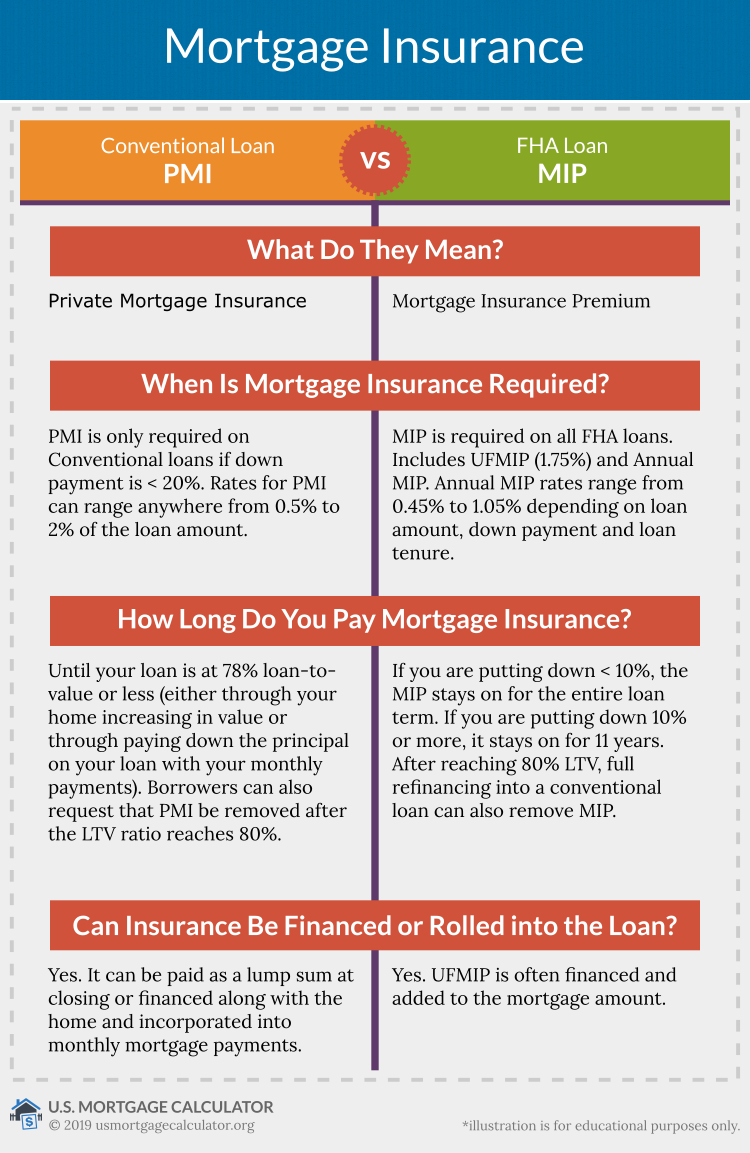

Private mortgage insurance, or PMI, is typically required with most conventional mortgage programs when the down payment or equity position is less than 20% of the property value. This coverage, which is purchased at your expense and typically paid as a monthly premium, protects your lender if you default on your mortgage loan until enough equity is established in the property. PMI can be removed once that equity is built up or if the property's market value increases. PMI isn't included on government-backed mortgages like an FHA loan or a VA loan. These mortgage programs have their own types of coverage and related costs that may be required, such as mortgage premium insurance that is paid both monthly and at closing.

While your lender isn't legally required to remove PMI at this point, they do have to remove it once your home loan hits 22 percent equity. Once your PMI requirement is canceled - whether you refinance the home or reach the required equity threshold - this monthly payment will drop off. Almost every type of home loan requires mortgage insurance if you put less than 20% down. Only conventional loans with 20% down or more are automatically exempt from PMI. Private mortgage insurance protects your lender from financial losses it might sustain if you default on your mortgage and it has to foreclose. The general rule of thumb is that if you put 20% down, your lender won’t lose much money in a foreclosure.

HOMEOWNERS PROTECTION ACT (PMI CANCELLATION ACT)

Once you have at least 20% equity in your home, you can ask your lender to cancel your PMI. Once you have 22% equity, the lender is required to automatically cancel the coverage. Keep in mind that only some lenders offer this type of insurance. And LPMI can’t be removed once a certain equity threshold has been reached. A VA loan doesn’t require a down payment or mortgage insurance to secure it. It’s open to eligible veterans and active-duty service members or surviving spouses.

There is a growing trend for BPMI to be used with the Fannie Mae 3% downpayment program. In some cases, the Lender is giving the borrower a credit to cover the cost of BPMI. In the United States, PMI payments by the borrower were tax-deductible until 2018. PMI might seem unappealing, but it’s actually a very useful tool for home buyers. Using a low-down-payment loan with PMI can put you in a home much sooner than you thought possible. And remember that PMI isn’t forever; you’ll eventually be able to remove it.

What is a home equity loan?

Although the borrower is committed on two loans, PMI is not required since the funds from the second loan are used to pay the 20% deposit. Some borrowers can deduct the interest on both loans on their federal tax returns if they itemize their deductions. This cost may be a good reason to avoid taking out PMI, along with the fact that canceling, once you have it, can be complicated. However, for many people PMI is crucial to buying a home, especially for first-time buyers who may not have saved up the necessary funds to cover a 20% down payment.

You can pay PMI in monthly installments or as a one-time payment, though the rate for a single payment would be higher. Full BioJean Folger has 15+ years of experience as a financial writer covering real estate, investing, active trading, the economy, and retirement planning. She is the co-founder of PowerZone Trading, a company that has provided programming, consulting, and strategy development services to active traders and investors since 2004. Mortgage insurance is different for government-backed mortgages like Federal Housing Association loans. In most cases, lenders require the borrower to pay PMI until there is enough equity in the home.

CFPB Takes Action Against Carrington Mortgage for Cheating Homeowners out of CARES Act Rights

You notice that local news reports indicate that property values are rising. Based on some initial research, you estimate the current value to be $365,000. In this example, the lender will charge PMI until you qualify for auto-cancellation at 78% LTV or request PMI termination at 80% LTV. Sometimes paying PMI as an extra monthly charge is well worth the ability to buy a home before you can afford 20% down. And because PMI can add tens of thousands of dollars in housing costs over the life of a loan, it’s important to consider taking steps to remove PMI as soon as you’re eligible. Whether your individual mortgage qualifies for PMI removal will depend on factors like how much you still owe on the loan and your payment history.

PMI is arranged by the lender and provided by private insurance companies. PMI is usually required when you have a conventional loan and make a down payment of less than 20 percent of the home’s purchase price. If you’re refinancing with a conventional loan and your equity is less than 20 percent of the value of your home, PMI is also usually required. As the name implies, split-premium mortgage insurance allows you to split up your PMI costs.

United States

The borrower can pay for PMI in monthly installments or as an upfront fee. Your lender can also require you to provide evidence that the value of your property hasn’t declined below the original value of the home. If the value of your home has decreased below the original value, you may not be able to cancel PMI at this time. You must have a good payment history and be current on your payments. Investopedia requires writers to use primary sources to support their work.

On a purchase or streamline refinance, the fee may exceed the VA appraised value! Even though VA allows the fee to be financed, a borrower may pay it from their own funds at closing. Another strategy is that a seller may pay the fee through seller paid VA concessions. You also shouldn’t have any 30-day late payments for the last year or 60-day late payments for the last two years.

You can also ask your lender to cancel PMI if your equity reaches at least 20% due to rising property values or improvements you've made to the home—but you'll need an appraisal to prove your case. If applicable, obtain a sample of any lender defined “high risk” PMI residential mortgage transactions that have a 77% or lower LTV based on the original value of the property. Verify that PMI was cancelled on the date that the principal balance of the loan was scheduled to reach 77% of the original value of the mortgaged property. (§ 4902 ) Verify that this date was based on the initial amortization schedule or the amortization schedule then in effect . Most homebuyers have to get PMI due to not having as large of a down payment. In fact, the median down payment was 12% in 2019, according to a National Association of Realtors survey.

Closing costs could total between 3% and 6% of your mortgage principal, which might add up to several thousand dollars on a $200,000 mortgage. You’ll likely need to get a new appraisal—at your expense—so that a professional third-party source can confirm your new home value. An appraisal can cost several hundred dollars, so confirm that your lender will accept the evaluation of a real estate broker, which could cost less. If you don’t want to wait at least a few years until you reach the 20% equity threshold to have your PMI removed, you have three other options. Using a piggyback loan to cover all or part of the down payment.

No comments:

Post a Comment